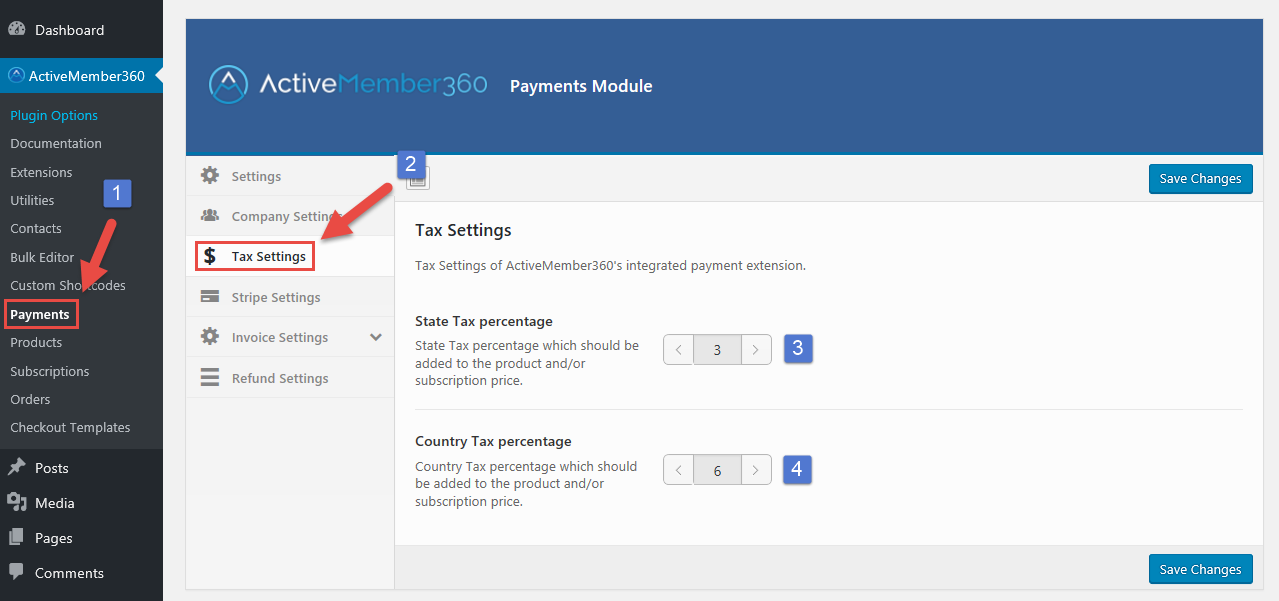

How to setup your sales tax:

- Click on “Payments” in the ActiveMember360 menu on your left-hand menu sidebar.

- Click on the “Tax Settings” section inside the “Payments Module” interface.

- If you’re based in the USA where a sales tax is levied at the state level, enter the applicable percentage here.

- Define your country’s national sales tax here, if applicable.

Don’t forget to save your changes!

Note:

The sales tax defined in the above steps will be charged if the customer’s location matches with company’s location, in whole or in part.

The sales tax defined in the above steps will be charged if the customer’s location matches with company’s location, in whole or in part.

Examples:

- If you’re based in Germany, you would have defined a state/province sales tax of 0% and a country sales tax of 19%. The total percentage of 19% will only be charged if your customer is also located in Germany, otherwise no sales tax will be charged.

- For the sake of this next example, let’s say that you’re based in the U.S. where a national sales tax is charged, as well as a state sales tax. If the national sales tax were set at 10% and the sales tax in your state were 5%, the following would apply:

- If the customer is outside your U.S, no sales tax will be charged (0%).

- If the customer is in U.S. but in a different state, only the 10% national sales tax will be charged.

- If the customer is both in the U.S. and in your state, a combined sales tax of 15% will be charged: 10% national sales tax and 5% state sales tax.

State sales tax is currently only available for businesses based in the U.S.